ARR is dead. Long live VRR

AI startups have co opted SaaS terminology. Well, they have just co opted the ones which increase their valuation :)

ARR is king now. Churn, LTV, CAC. We dont hear those anymore.

And because AI startups are using the same vocabulary of SaaS startups, real SaaS startups are suffering. I think we need to come up with new vocabulary.

The industry is currently suffering from “Novelty Inflation,” where traditional SaaS metrics like ARR (Annual Recurring Revenue) are failing to distinguish between a product that is a toy and a product that is a tool. In fact, in many cases, its actually nefarious as founders are hyping up their products by making loose interpretations of the meaning of ARR(I have had some founders tell me they calculate ARR as the best day of the week * 365).

To solve this, we need a metric that discounts “curiosity capital” and focuses on “utility retention.” Please welcome Vibe Revenue Run-rate.

Let’s define and operationalize VRR: Vibe Revenue Run-rate.

1. The VRR Formula: A Scientific Approach

Traditional ARR assumes that $1 earned today is worth $12 over a year. VRR challenges this by applying a **Utility Decay Coefficient (δ)**.

The Core Formula

Where the Utility Decay Coefficient (δ) is calculated based on three “Vibe-Check” variables:

Workflow Integration Score (W): Measures the depth of API calls or “boring day” usage versus “wow moment” usage.

Model Independence Factor (M): Measures if the user stays even when a better/cheaper model (e.g., GPT-5 or Claude 4) is released elsewhere.

Churn-Adjusted Velocity (Churn): Penalizes revenue from users who haven’t crossed the “Habit Horizon” (typically Month 5 in AI).

The delta Calculation

If δ approx 1: The revenue is “Hard Revenue” (High Utility).

If δ < 0.4: The revenue is “Vibe Revenue” (Pure Novelty).

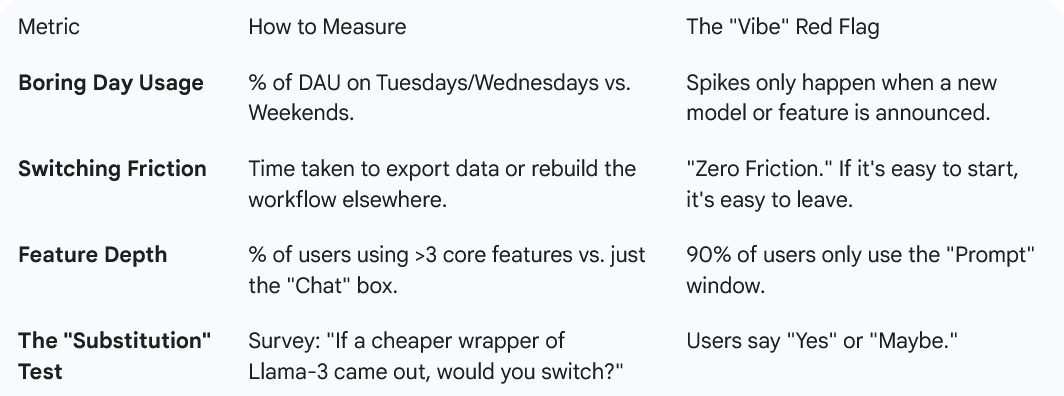

2. The VRR Audit: How VCs Should Calculate It

To move from “Vibe” to “Value,” VCs must demand a Cohort Utility Audit during due diligence. Here is the framework for calculating VRR:

3. Why VRR is Superior to ARR for AI Startups

A. ARR Rewards System Of Record

Traditional SaaS is a system of record. So generally once a customer is onboarded they have an LTV(life time value). With AI you move to a system of action or system of work. The LTV is different here. The default calculation of ARR might still work well, but new definitions of ARR(best day*365 etc) don’t give the right picture.

B. The “Worst-Model-Ever” Fallacy

Founders argue that better models will fix churn. VRR proves that retention is a product problem, not a model problem. If the VRR is low despite high ARR, it proves the product has “Shallow Integration.”

C. Protecting Talent and Capital

Employees are currently taking equity in “Vibe Companies” based on 50x ARR multiples. VRR provides a realistic valuation framework that prevents “Paper Millionaire” syndrome by valuing companies on sustainable habits rather than temporary FOMO.

4. The Investor’s Defensive Playbook

If you are a VC, you should look for the “VRR Gap”—the difference between reported ARR and calculated VRR.

The Rule of Thumb: > * Healthy AI Startup: VRR is >70% of ARR.

Vibe-Trap Startup: VRR is <30% of ARR.

The Vibe-Trap startup will show a beautiful exponential ARR curve, but the VRR curve will be flat or declining, signaling that while new people are joining the party, nobody is staying for dinner.

VRR Due Diligence Checklist

1. Usage Architecture

• Boring Day Ratio: What % of weekly active users log in on Tuesday-Thursday? (Goal: >60%)

• Session Intent: % of sessions that involve a multi-step workflow vs. a single prompt-and-exit.

• Feature Breadth: % of power users utilizing >3 non-chat features (e.g., exports, integrations, collaboration).

2. Retention & Habit Horizon

• The Month-5 Cliff: Retention rate of the Month 5 cohort vs. the Month 1 cohort.

• Natural Frequency: Does the product’s value proposition align with a daily, weekly, or monthly habit?

• “Wow” Decay: Average time spent in-app per user over their first 90 days.

3. Structural Moats (Switching Costs)

• Data Persistence: Does the user lose proprietary data or context if they switch models?

• Workflow Gravity: Is the tool the “system of record” or just a “utility window”?

• Integration Depth: Number of active API connections per seat.

4. Model Independence

• Input-to-Output Ratio: How much value is added by the product vs. the underlying LLM?

• Proprietary Context: Does the startup have a unique RAG/Fine-tuning layer that persists across model upgrades?

Case Study: ARR vs. VRR (Platforms like Lovable.dev / Vibe Coding)

The Narrative (ARR View)

• Reported ARR: $10M+

• Growth: 30% Month-over-Month.

• The Pitch: “We are the frontend for the AI generation. Users build production-ready apps in minutes.”

• Investor Deck: Shows a hockey stick of ‘Apps Created’ and ‘New Pro Subscriptions’.

The Reality (VRR View)

Platforms like Lovable (and tools like Bolt or Replit Agent) are currently the epicenters of Vibe Revenue because they rely on the “One-Off Project” trap.

The VRR Leakage Factors:

1. The “Tourist” Problem: A founder pays $20 to build a landing page. Once the page is done, the subscription is canceled. ARR counts this as $240 ($20 x 12), but VRR counts it as $20.

2. Model Fragility: If a user finds a better agent (e.g., Cursor + Composer), they switch instantly because their code is portable.

3. The Habit Ceiling: Building a new app is a high-energy, low-frequency event. VRR requires maintaining an app to be the core habit.

Calculating the VRR:

• Gross ARR: $10,000,000

• Utility Decay Coefficient (δ): 0.25 (High churn after project completion + low model independence).

• Calculated VRR: $2,500,000

Verdict:

While the company is “making” $10M, only $2.5M represents a sustainable, habit-formed business. The other $7.5M is “Vibe Revenue”—money paid for the magic trick of seeing an app appear, not for the labor of running a business.

To make this easier, I have vibe coded(I see the irony :)) a VRR calculation app.